Find your old 401(k)s

- Discover your 401(k) hidden fees

- Rollover and save thousands

- Unlock your 401(k)s and IRA

- ...and more!

WHAT WE DO

Solve the complexities in your journey towards retirement

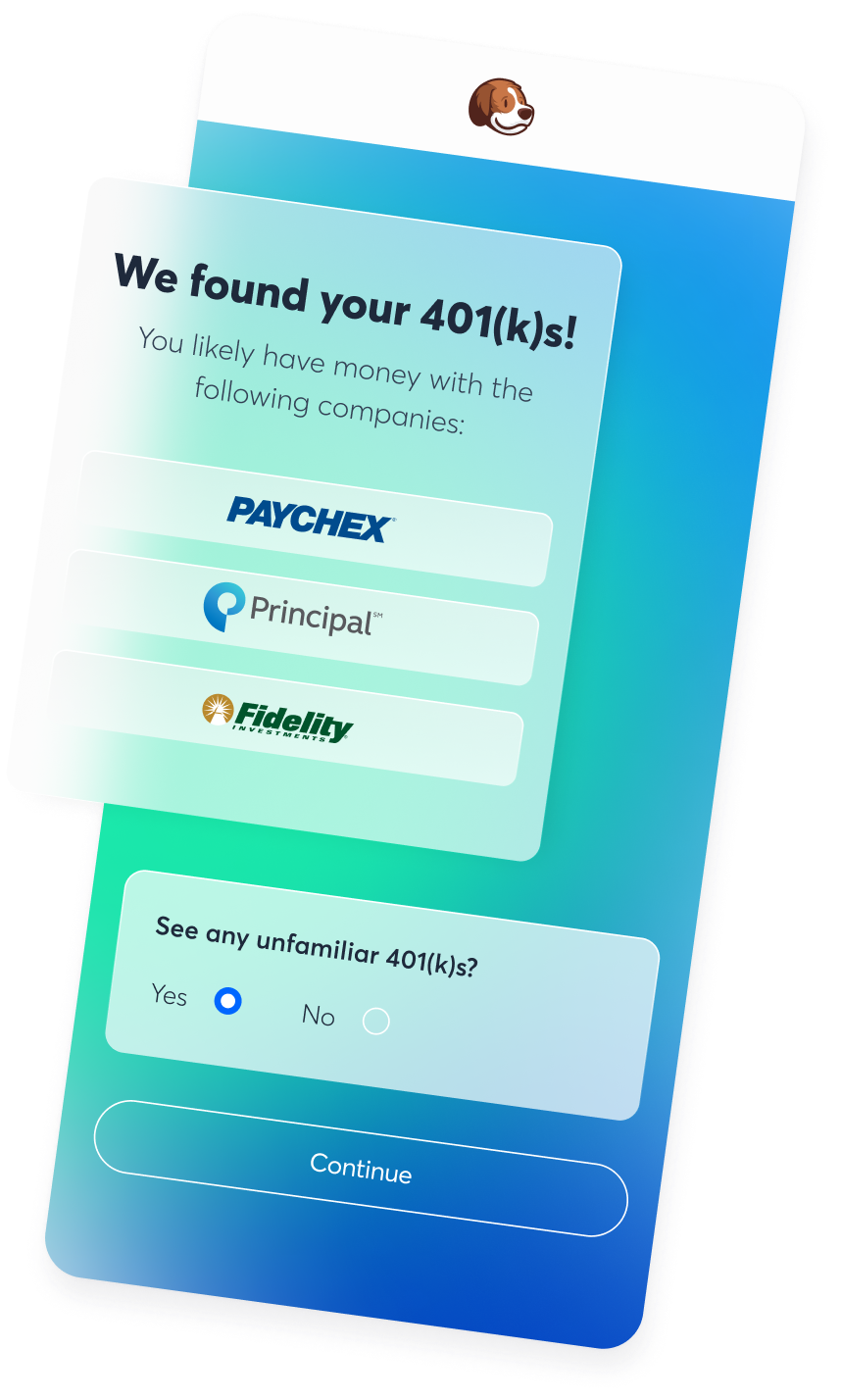

Find Your Old 401(k)s

Find The Hidden Fees

Hassle-Free Rollover

Unlock old 401(k)s/IRA

WHAT YOU GET

Peace of mind

It’s not chump change

Never lose your money again

Know exactly what you’re paying

All your money in the same place

Access to 401(k)s before you retire

FAQ

We are here to help

What’s a 401(k) plan?

A 401(k) is a retirement plan that employers provide to their employees. Employees contribute to the 401(k) through automatic paycheck deductions. The employer may match part or all of the employee’s contribution up to the dollar limit determined by the Internal Revenue Service (IRS), which is $19,500 for employees under 50 years, and $26,000 for employees 50 years and above in 2020/21, or 100% of the employee’s wages, whichever is higher. For example, the employer may contribute 40 cents for every dollar that the employee contributes.

Employees enjoy a tax break on their 401(k) contributions. The contributions deducted from the employee's paycheck are automatically invested in specific investments from a list of available offerings that may include stocks, mutual funds, bonds, employer's own stock, and guaranteed investment contracts. These investments are typically tax-free, until after the employee withdraws the earnings after retirement. If the employee withdraws the earnings post-retirement, the money is taxed at the ordinary tax rate, depending on their tax bracket. For Roth 401(k) withdrawals, the money can be tax-free.

How do I find my old 401(k)?

If you are trying to find the money left in your former employer’s 401(k), here are possible places to find them:

If you are trying to find your old 401(k), you can use an online service such as Meetbeagle.com. Beagle allows you to track your old 401(k) to see the hidden fees charged to your account, and rollover to a better retirement account with just one click.

What are 401(k) fees?

401(k) fees are the costs charged to your 401(k), and they range anywhere from 0.5% to 2% of the value of assets, depending on the plan provider, size of the employer's 401(k) plan, and the number of participants.

The US Department of Labor groups the 401(k) fees into the following categories:

What's a 401k rollover?

A 401(k) rollover is a transfer of funds from your 401(k) plan account to a new plan or Individual Retirement Plan. When you move between jobs, you can transfer your old 401(k) to the new employer’s 401(k) plan or a retirement plan provided by a financial institution, also known as an IRA. An IRA allows you to invest in almost every type of asset, including stocks, mutual funds, real estate investment trusts (REITs), bonds, etc.

The IRS requires retirement plan distributions to be transferred to a 401(k) or IRA within 60 days to enjoy tax breaks. A 401(k) rollover can take the following two forms:

Direct rollover

A direct rollover is where the funds from the 401(k) are transferred electronically into the IRA without going through the account holder, also known as custodian-to-custodian transfers.

Indirect Rollover

An indirect rollover is where the 401(k) institution sends a paper check to the account holder, who is then required to deposit the check to the new IRA. The 401 (k) administrator may withhold 20% tax from your savings. You must deposit the full account balance, including the amount withheld as taxes, within 60 days from the date you received the distribution.

For example, if the 401(k) account balance was $15,000, and the employer mails you a check for $12,000, $3,000 or 20% is withheld for taxes, and deposit the full balance of $15,000 into the new retirement account. The IRS will refund you the $3000 that the employer held back as tax.